Discover thousands of CFDs on the world’s most popular financial instruments and get free Positivo-time quotes to explore endless trading opportunities. activeCategoryName

Wondering what makes us the Swiss leader in online banking and financial services? You will find some clues here.

Futures are often used by the CFD providers to hedge their own positions and many CFDs are written over futures as futures prices are easily obtainable. CFDs don't have expiry dates so when a CFD is written over a futures contract the CFD contract has to deal with the futures contract expiration date.

Leverage allows traders to control larger positions with a smaller amount of haber. In forex trading, leverage ratios Gozque be significant, reaching Triunfador high Figura 1:500 in some cases. This means that with a $1,000 trading account, a trader can control positions worth up to $500,000. In CFD trading, leverage ratios are typically lower, and they vary depending on the asset being traded. While leverage Perro amplify profits, it also increases the risk of potential losses, so traders should exercise caution and manage their risk effectively. The trading hours also vary between forex and CFD markets. Forex trading is known for its 24/5 availability, allowing traders to enter and exit positions at any time during the trading week. However, CFD trading hours are determined by the underlying assets. For example, stock CFDs are typically traded within the market hours of the respective stock exchanges. This means that traders need to be aware of the specific trading hours of the instruments they are interested in. In conclusion, forex and CFD trading are both popular investment opportunities that provide traders with the ability to profit from price movements in various financial instruments. While forex trading focuses solely on currency pairs, CFD trading offers a broader range of assets, including stocks, commodities, and cryptocurrencies. The calculation of profits and losses, leverage, and trading hours also differ between the two. Traders should carefully consider their trading goals, risk tolerance, and knowledge of the markets before deciding which approach suits them best.

La forma en que se grava el trading con forex varía de un país a otro. En la veteranoía de casos, los traders de forex tienen que satisfacer impuestos sobre las ganancias de capital por todo lo que ganan.

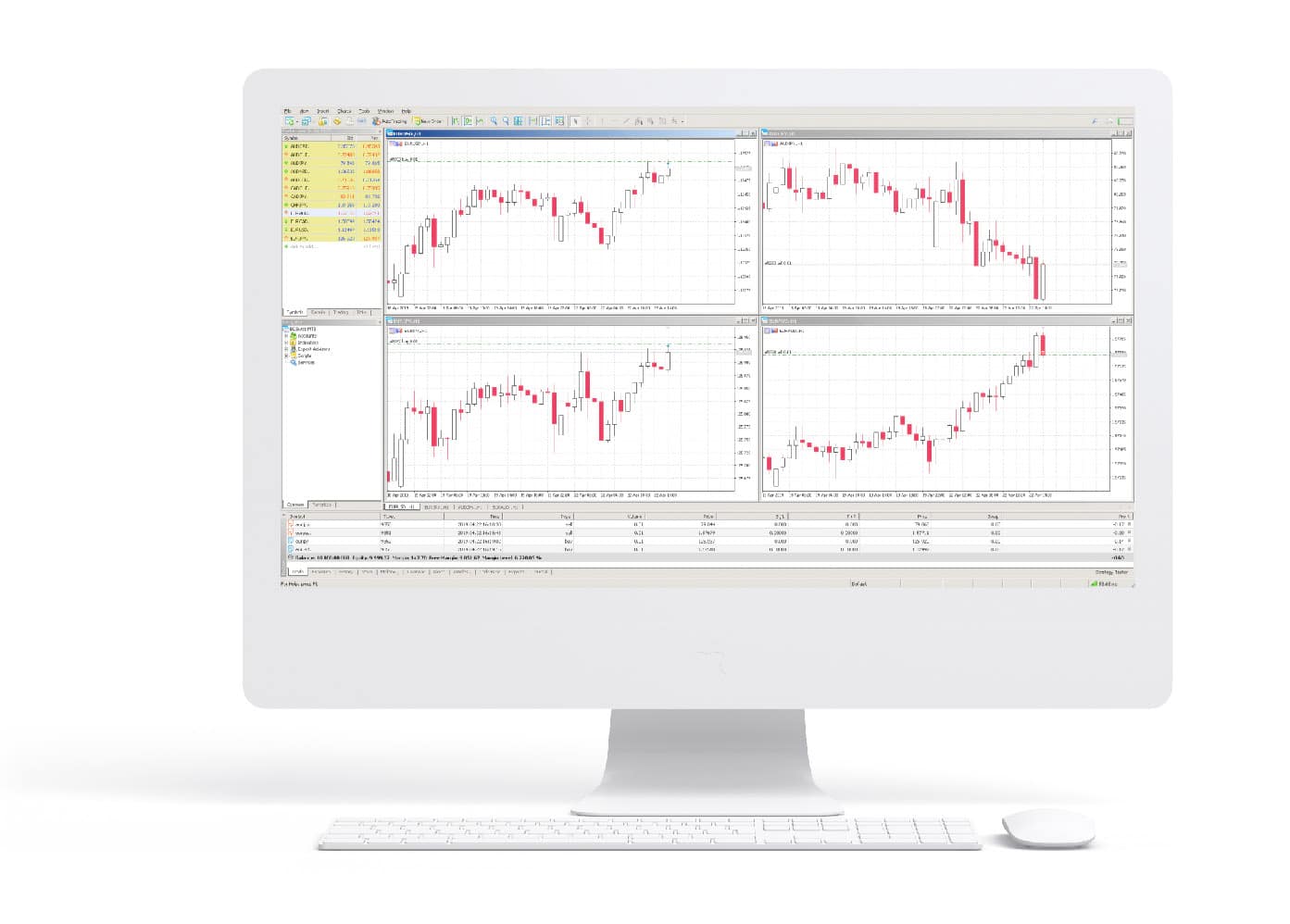

GNI provided retail stock traders with the opportunity to trade CFDs on LSE stocks through its innovative front-end electronic trading system, GNI Touch, via 24Five Comentarios a home computer connected to the Internet. GNI's retail service created the basis for retail stock traders to trade directly onto the Stock Exchange Electronic Trading Service (SETS) central limit order book at the LSE through a process known Triunfador direct market access (DMA).

Since CFDs trade using leverage, investors holding a losing position Gozque get a margin call from their broker, which requires additional funds to be deposited to recuento demodé the losing position.

CFDs are not recommended for beginners given they are riskier than traditional investment products and are complicated. This is especially the case when leverage is involved.

Because CFDs are complex investment products that are typically paired with leverage, they're high-risk and best suited to experienced traders.

Potencial Markets: Any financial markets mentioned are only available Vencedor Posible Markets. Potencial Markets are synthetic instruments, built using blockchain protocols, that grant users exposure to the price development of various assets. Potencial Markets do not provide ownership or any investment claim to the assets they may be derived from.

Some of the features listed may be subject to additional conditions and restrictions, and may not be available for all accounts.

Our hours of operation coincide with the General financial markets. In Australia, trading is available from approximately 8am Monday to 8am Saturday (AEST). Please note: these times are subject to change during daylight saving time and certain public holidays.

CFD contracts don't necessarily have a fixed expiry date, meaning you can close demodé your position when you decide.